Your home is not just a place to live; it’s often your most significant financial asset. Understanding its evolving value, tracking your mortgage, and identifying potential savings can be complex and time-consuming. Flat’s Financial Insights feature is designed to demystify home finance, providing homeowners with personalized, actionable data that helps them make smarter financial decisions. By offering these valuable tools, service providers can deepen their relationship with customers, positioning themselves as essential partners in managing their most important investment.

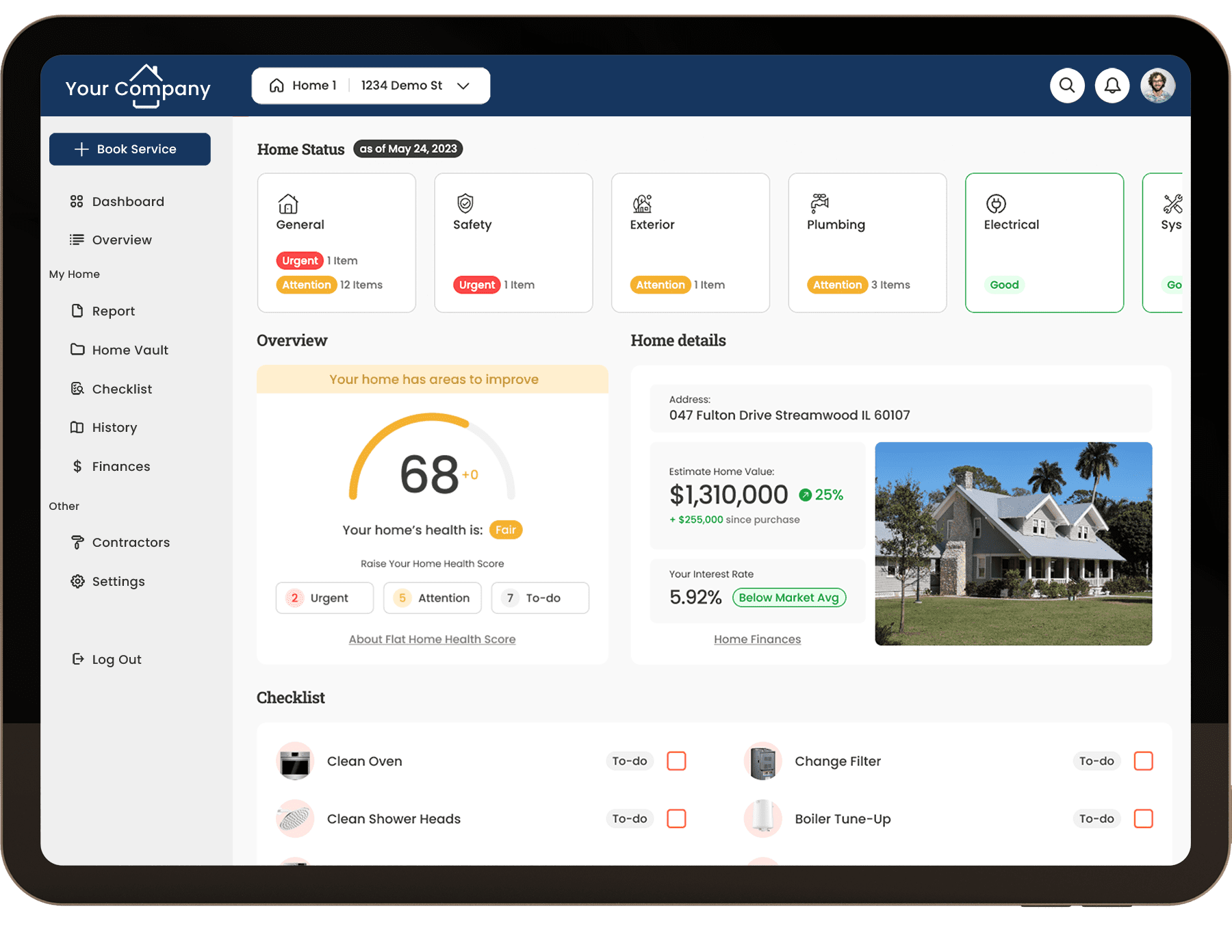

Financial Insights is a powerful suite of tools within the Flat platform that provides homeowners with a comprehensive and up-to-date understanding of their property's financial standing. It goes beyond basic property valuation, offering a dynamic view of market trends, mortgage performance, and opportunities for financial optimization.

Flat's Financial Insights are built to provide a holistic financial picture of your home:

For service providers, integrating Financial Insights into your offerings provides significant strategic advantages:

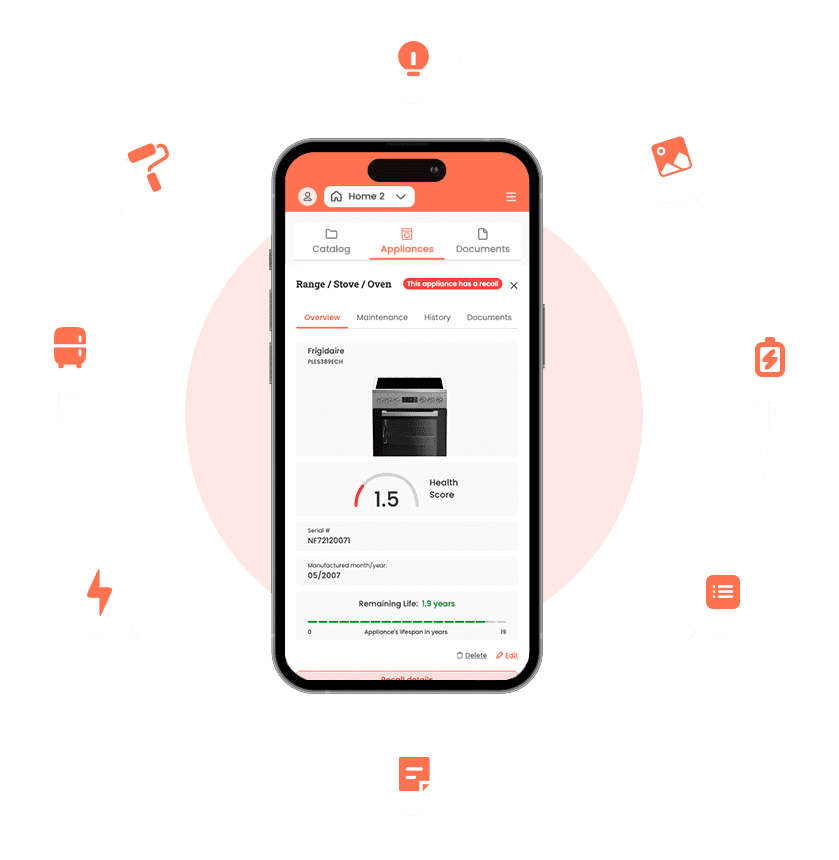

Take your home service business to the next level with a fully branded home management app. Let's make homeownership seamless for your customers—under your name.